The effects of Bernanke's Quantitative Easing (ie: printing money willy nilly without regard for the consequences) are being shown.

We are about six miles from the Canadian border as the crow flies. We get a lot of Canadian visitors and we take the currency at par. For the first time in about ten years, the Canadian dollar is trading higher than the US Dollar.

And the price of Diesel has hit the $4.00 mark -- it was $3.49 just a few months ago.

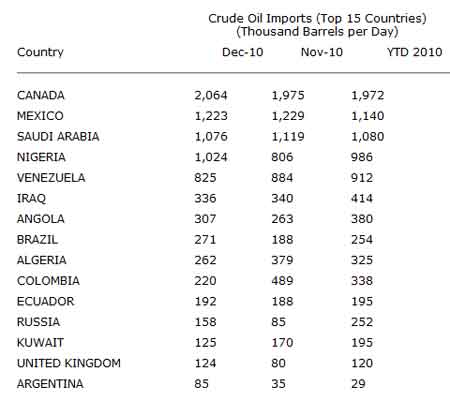

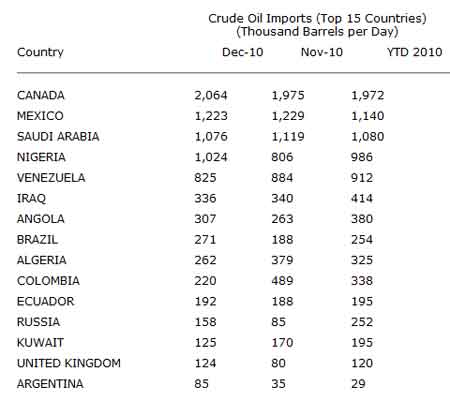

This price rise is not because of the middle east unrest -- we do not purchase oil from Libya.

From

here

This is the beginning of an inflationary spiral. The more gas prices rise, the more it costs to manufacture goods and provide services and those prices are going to rise as well. Because the businesses are having to spend that much more on energy and fuel costs, they will not be as inclined to give raises to their employees so the purchasing power will go down.

Because this comes at a time of high taxation for small businesses and when large (GE -- I'm talkin' to you!) businesses get political sweetheart deals (and don't contribute their fair share of tax revenue), the overall economy falls moribund.

There is a word for this -- Stagflation. Excerpted from

the WikiPedia article:

Both stagnation and inflation can result from inappropriate macroeconomic policies. For example, central banks can cause inflation by permitting excessive growth of the money supply, and the government can cause stagnation by excessive regulation of goods markets and labor markets, Either of these factors can cause stagflation. Excessive growth of the money supply taken to such an extreme that it must be reversed abruptly can clearly be a cause. Both types of explanations are offered in analyses of the global stagflation of the 1970s: it began with a huge rise in oil prices, but then continued as central banks used excessively stimulative monetary policy to counteract the resulting recession, causing a runaway wage-price spiral.

Welcome back Carter...

We don't purchase oil from Libya, but others do, and although there are differences in type and ability to refine it from different sources, largely it is fungible.

So if Italy have to buy their oil from Nigeria instead of Libya, that still means less supply/more demand/price increase.

I had an amusing conversation with an Australian in England about a previous version of that chart, however. He thought it was really stupid for GW Bush to say "More and more of our oil imports come from overseas." I brought up the then current version of that chart, and asked what sea was between the US and Canada, Mexico, or Venezuela, explaining that I had a hard time calling a place "overseas" if I could hop in my Chevy and drive there without using a ferry. The others in the party agreed with me that you had to be pretty provincial to assume that every country was an island, even if you were from one such and living in another such.