Ho. Li. Crap. Newsweek - famous for their We Are All Socialists Now front cover about ten years ago.

They got it right this time:

Climate Activism Isn't About the Planet. It's About the Boredom of the Bourgeoisie

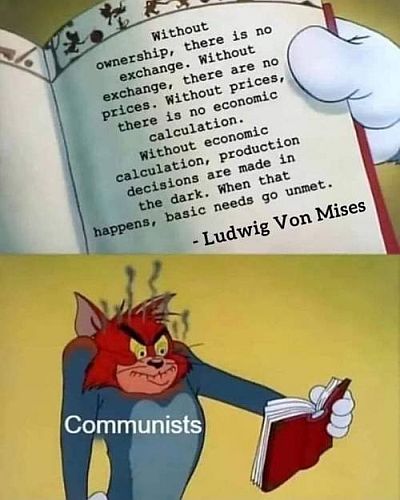

The downfall of capitalism will not come from the uprising of an impoverished working class but from the sabotage of a bored upper class. This was the view of the Austrian economist Joseph Schumpeter in 1942. Schumpeter believed that at some point in the future, an educated elite would have nothing left to struggle for and will instead start to struggle against the very system that they themselves live in.

Nothing makes me think Schumpeter was right like the contemporary climate movement and its acolytes. The Green movement is not a reflection of planetary crisis as so many in media and culture like to depict it, but rather, a crisis of meaning for the affluent.

Take for example a recent interview with Stanford biologist Paul Ehrlich on CBS's 60 Minutes. Ehrlich is most famous for his career as a professional doom monger. His first major book, The Population Bomb, gave us timelessly wrong predictions, including that by the 1980s, hundreds of millions of people would starve to death and it went downhill from there. Ehrlich assured us that England would no longer exist in the year 2000, that even modern fertilizers would not enable us to feed the world, and that thermonuclear power was just around the corner.

Ehrlich, who recently turned 90, is in the lucky position to have witnessed the complete failure of all his predictions—only to double down on them in his 60 Minutes interview Ehrlich has been wrong on every public policy issue he pontificated on for almost 60 years, yet the mainstream media still treat him like a modern oracle.

Why?

The best answer to this question comes courtesy of New York Congresswoman Alexandria Ocasio-Cortez, who in 2019 famously said that, "I think that there's a lot of people more concerned about being precisely, factually and semantically correct than about being morally right." In other words, no matter what nonsense one spews, as long as it is "morally right," it does not matter what the facts show.

Much more at the site. 110% spot on.

The author has quite a bit of cred:

Ralph Schoellhammer is an assistant professor in economics and political science at Webster University, Vienna.

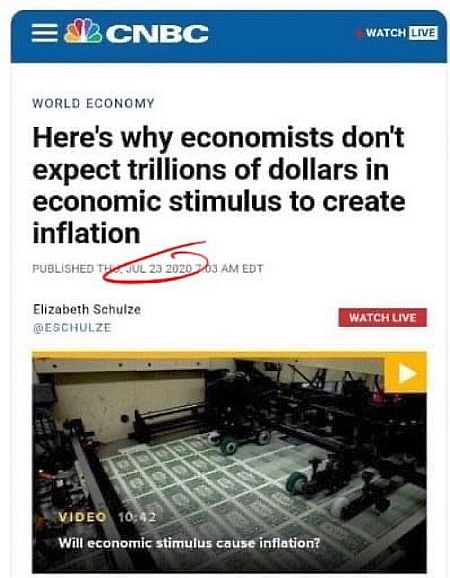

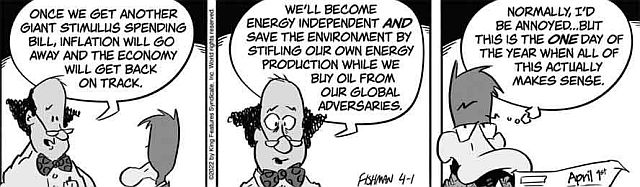

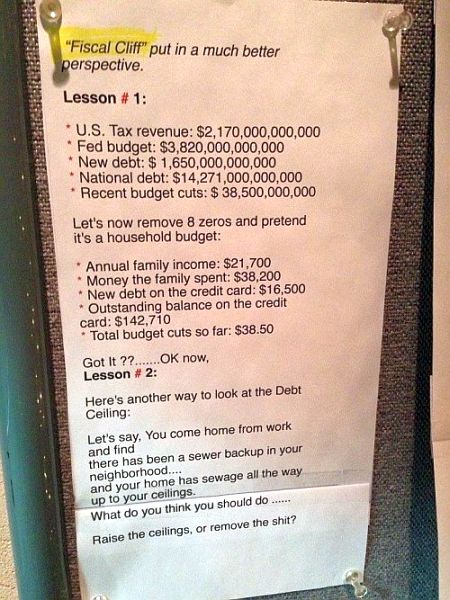

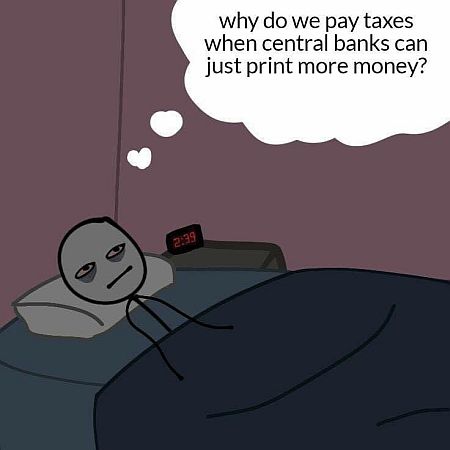

Going to see if he has any books out... Looks like someone with a good head on their shoulders. Always been an Austrian economist. J. M. Keynes has gotten too much traction much to the detriment of the world. Modern Monetary Theory is bunk. Trash. Discredited.