Talk about unintended consequences - I know I am preaching to the choir but this is a very well-written and succinct essay. From The Mises Institute:

How Shutdowns Will Keep Killing the Economy, Even When They're Over

Imagine what it is like right now to plan for the future as a business owner. The owner doesn't know if he or she will even be allowed to be open for business two weeks from now, or a month from now.

Indeed, politicians and their unelected (and unaccountable) health advisors keep insisting that they might elect to close down businesses or impose new restrictions on large portions of the economy at any time.

The uncertainly associated with all this is immense. Consider some examples: thanks to moratoria on evictions in many cities, renters who can't pay rent — thanks in part to government-forced lockdowns — can stay in their rental units indefinitely. Landlords have no idea when they will next be able to actually collect revenues again from paying customers. Meanwhile, "elective" healthcare services like eye care and dental care have been deemed "unessential" by bureaucrats and governors in many states. These offices will be closed and collecting little-to-no revenue. Restaurants, of course, aren't permitted to do business beyond take-out service in places with lockdowns. (Although these restaurants still have to pay rent for their dining rooms.)

Even beyond the short term, business owners have no way to plan. If a business owner is allowed to actually conduct business during the summertime this year, it may still be that politicians will later elect to shut businesses whenever it is decided the risk of spreading viruses demands another "shutdown." We're even told this could go on for years.

One would have to be impressively naive and deeply ignorant about how businesses work to think that commerce, investment, and entrepreneurship would just continue as usual under these conditions. In reality, the threat of a government-mandated lockdown hanging over the heads of countless business owners and entrepreneurs will mean there will be far less willingness and ability to invest in businesses, offer products and services, or employ people.

Much much more at the site. The author cites economic historian Robert Higgs:

Specifically, Higgs has illustrated that regime uncertainty was a significant factor in making the Great Depression such a long and unpleasant affair. The Roosevelt administration's numerous and enormous changes to the legal regime — through new taxes, regulations, and labor laws — made the Depression far worse than it needed to be. Higgs explains how thanks to a multitude of state interventions during the Depression:

the Roosevelt administration “abruptly and dramatically altered the institutional framework within which private business decisions were made, not just once but several times” ... with the result that regime uncertainty was heightened and recovery substantially retarded.

As one investor at the time observed:

Uncertainty rules the tax situation, the labor situation, the monetary situation, and practically every legal condition under which industry must operate. Are taxes to go higher, lower or stay where they are? We don’t know. Is labor to be union or nonunion?... Are we to have inflation or deflation, more government spending or less?... Are new restrictions to be placed on capital, new limits on profits?... It is impossible to even guess at the answers.

The result was "the New Deal prolonged the Great Depression by creating an extraordinarily high degree of regime uncertainty in the minds of investors."

The recovery was slowed, of course, because investing, building businesses, and engaging in innovation became far riskier and unpredictable thanks to the chances that governments might once again impose draconian new restrictions on businesses. This changed the calculus completely.

And the media pundits are talking about how we need a New New Deal to get back up and running not realizing that the original New Deal stalled recovery for many years. Not entirely happy with President Trump's choice of Steven Mnuchin as Sec. Treasury - I would prefer someone more from the Austrian school - Hayek, Mises - those guys.

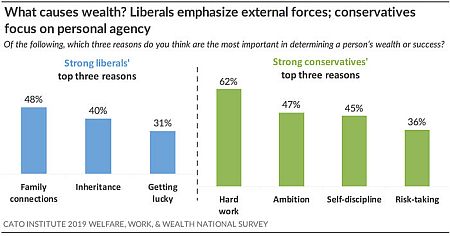

J. M. Keynes has been wrong on so many real-world counts that his popularity today is really questionable. That whole "locus of control" issue I talked about earlier here. More here (really good reading) including this chart:

Classic video from the Obama recession:

More from these people here - excellent stuff.

The same people also did this video - available on Netflix and will be watching it soon.

Leave a comment